BLOG

Ethereum’s Secret Weapon: Staking Issuance Reduction

The battle over which blockchain will be the backbone for the next generation of the internet is well underway, with Ethereum and Solana currently leading the pack. Despite Ethereum’s loss of market dominance, it holds a secret advantage that is poised to reshape the landscape: staking issuance reduction. This strategic move could potentially catapult Ethereum to new heights, inspiring confidence in its future.

Though blockchains are great for securing data in a verifiable, trustless, and decentralized manner, several factors dictate how well a certain chain performs these functions. The two most important variables are safety, the ability of a blockchain’s history to stay immutable and unchanged, and liveness, the capacity of a chain to continue progressing and making blocks even in the presence of adversarial nodes. Bitcoin, the first blockchain, solves these problems through proof of work — requiring validators to purchase and operate specialized hardware to build blocks and collect network fees. These validators are incentivized to act honestly, as they would be wasting electricity and the opportunity cost of their hardware if they attempted to create bad blocks or break the chain’s rules.

Proof-of-stake blockchains, like Ethereum and Solana, take a different approach by requiring validators to pledge the chain’s native currency as collateral as “stake” to validate blocks and earn fees. Though this method has its pros and cons, it is generally seen as more efficient, both in terms of energy required and the speed of consensus.

Both forms of consensus leave us with a level of economic security defining how easy or difficult it would be for a malicious actor to break the safety and liveness properties by acquiring majority control over the network consensus. For Bitcoin, it is the cost to gather and operate 51% of the network’s computing power; for Ethereum, it is 33% of the total amount of staked ETH to prevent the network from further finalizing blocks or 66% to stall the network. These thresholds hold true for most other proof of stake chains.

Ethereum’s status as the largest and most established smart contract platform, with the highest market capitalization, is by far its biggest strength in maintaining high economic security. With over 32 million staked ETH, a 34% attack would cost 10 million ETH or over $40 billion at current prices. This does not include the increase in cost that would come with acquiring this ETH on public markets. Solana, on the other hand, has 363 million SOL staked, with a 34% attack costing around $20 billion. This robust economic security underscores the stability of Ethereum and Solana.

Though both blockchains have enough at stake to effectively prevent an attack, this does not tell the whole story. Ethereum researchers have been discussing reducing the issuance rate of ETH to validators, meaning that less ETH would come into the supply to reward node operators. There might even be a point at which if more than a certain proportion of ETH is staked on the network, the staking rewards become negative. This ensures that the network is not overpaying for security and emphasizes the role of ETH as an ecosystem coin on both the mainnet and in various L2 ecosystems. This potential reduction, alongside Ethereum’s already near-0 inflation rate, would supercharge the network’s economics and make it nearly impossible for other chains to keep up. Solana, for example, inflates its token at around 10% per year and has staking rewards around the same. This means that if you aren’t actively staking your SOL, it dilutes value by 10% annually. On the other hand, Ethereum’s 0–1% inflation combined with its 2–3% staking reward offer incentives to stakers while still ensuring that ETH is not diluted for those using it in other applications like DeFi or simple custody.

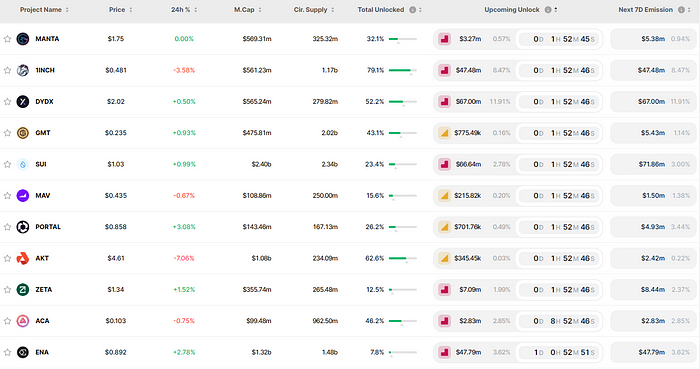

Some alternative L1s also have VC token unlock schedules, where early investors can sell their tokens after holding them for years. In most cases, these unlocks are bearish for the token price, as they drastically dilute the circulating supply with additional tokens. Since Ethereum was fairly launched in 2014, it has no unlocks to speak of; thus, there is little cyclical sell pressure on the token that other blockchains face.

Ethereum’s key strength lies in a little-known fact about the future of its staking issuance. As a near-deflationary asset, it has already almost equalized its spending and revenue, and a reduction would put it firmly into a revenue-generating state. Other L1s with high inflation required for incentivizing economic security may be unable to compete and thus unable to keep up as the flywheel effect keeps growing Ethereum. Only time will tell if this theory will come true and if the reduction goes through, but the future of Ethereum seems brighter than ever.